Breaking Down Lattice Semiconductor: 8 Analysts Share Their Views

Analysts' ratings for Lattice Semiconductor (NASDAQ:LSCC) over the last quarter vary from bullish to bearish, as provided by 8 analysts.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 4 | 2 | 0 | 0 | 0 |

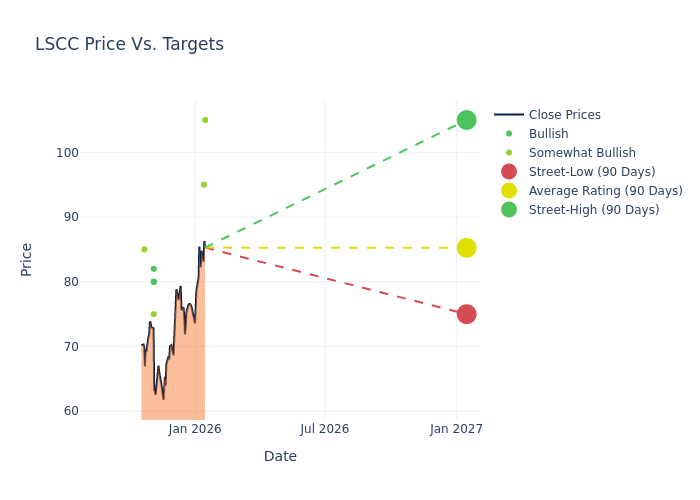

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $85.25, with a high estimate of $105.00 and a low estimate of $75.00. Surpassing the previous average price target of $71.00, the current average has increased by 20.07%.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of Lattice Semiconductor by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Srini Pajjuri | RBC Capital | Announces | Outperform | $105.00 | - |

| John Vinh | Keybanc | Raises | Overweight | $95.00 | $85.00 |

| Tristan Gerra | Baird | Raises | Outperform | $75.00 | $60.00 |

| Kevin Cassidy | Rosenblatt | Raises | Buy | $80.00 | $72.00 |

| Ruben Roy | Stifel | Raises | Buy | $80.00 | $60.00 |

| David Williams | Benchmark | Raises | Buy | $82.00 | $75.00 |

| N. Quinn Bolton | Needham | Maintains | Buy | $80.00 | $80.00 |

| Christopher Rolland | Susquehanna | Raises | Positive | $85.00 | $65.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Lattice Semiconductor. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Lattice Semiconductor compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Lattice Semiconductor's stock. This analysis reveals shifts in analysts' expectations over time.

Capture valuable insights into Lattice Semiconductor's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Lattice Semiconductor analyst ratings.

About Lattice Semiconductor

Lattice Semiconductor Corp is a developer of semiconductor technology that it distributes through products, solutions, and licenses. The company reaches its customers through consumer, communications, and industrial markets. The company has one operating segment namely the core Lattice business that includes silicon-based and silicon-enabling products, evaluation boards, development hardware, and related intellectual property licensing, services, and sales. The products of the company are offered globally; and, the majority of sales are derived from customers in Asia. It also has its presence in Americas and Europe.

Breaking Down Lattice Semiconductor's Financial Performance

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Positive Revenue Trend: Examining Lattice Semiconductor's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.92% as of 30 September, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Lattice Semiconductor's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 2.1%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Lattice Semiconductor's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.4%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Lattice Semiconductor's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.34%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Lattice Semiconductor's debt-to-equity ratio is below the industry average. With a ratio of 0.03, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.