Beyond The Numbers: 4 Analysts Discuss Mama's Creations Stock

During the last three months, 4 analysts shared their evaluations of Mama's Creations (NASDAQ:MAMA), revealing diverse outlooks from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

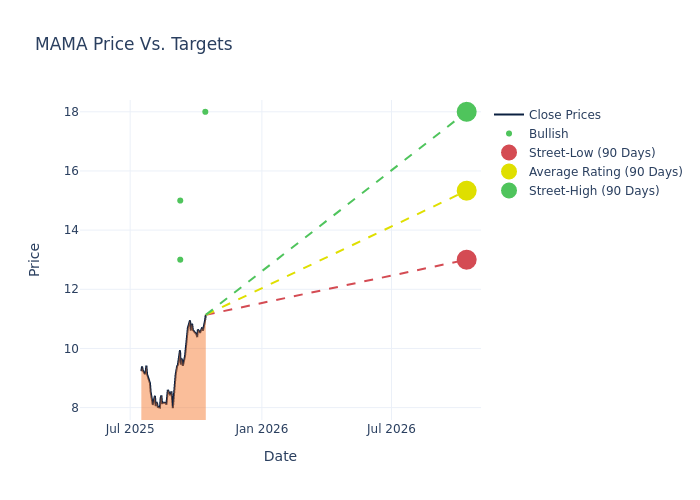

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $16.0, a high estimate of $18.00, and a low estimate of $13.00. Surpassing the previous average price target of $13.00, the current average has increased by 23.08%.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Mama's Creations's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brian Holland | DA Davidson | Maintains | Buy | $18.00 | $18.00 |

| Brian Holland | DA Davidson | Announces | Buy | $18.00 | - |

| George Kelly | Roth Capital | Raises | Buy | $13.00 | $10.00 |

| Ryan Meyers | Lake Street | Raises | Buy | $15.00 | $11.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Mama's Creations. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Mama's Creations compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Mama's Creations's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Mama's Creations's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Mama's Creations analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Mama's Creations

Mama's Creations Inc is a marketer and manufacturer of fresh deli-prepared foods, found in grocery, mass, club, and convenience stores nationally. The company's broad product portfolio, born from a rich history in Italian foods, now consists of a variety of high-quality, fresh, clean, and easy-to-prepare foods to address the needs of both consumers and retailers. The brand of the company includes Mama's Creations, Mama's Mancini's, The Olive Branch, Creative Salads, and others.

A Deep Dive into Mama's Creations's Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Positive Revenue Trend: Examining Mama's Creations's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 24.03% as of 31 July, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Consumer Staples sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Mama's Creations's net margin excels beyond industry benchmarks, reaching 3.63%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.56%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Mama's Creations's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.46% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Mama's Creations's debt-to-equity ratio is below the industry average. With a ratio of 0.36, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.