Assessing TTM Technologies: Insights From 6 Financial Analysts

In the last three months, 6 analysts have published ratings on TTM Technologies (NASDAQ:TTMI), offering a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

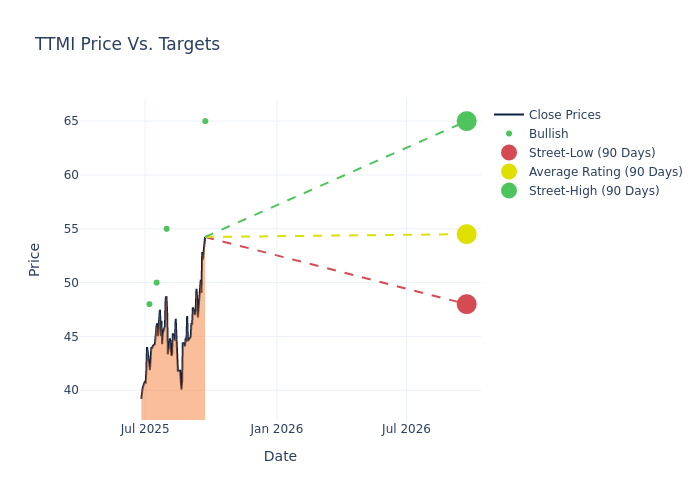

Insights from analysts' 12-month price targets are revealed, presenting an average target of $55.0, a high estimate of $65.00, and a low estimate of $48.00. Marking an increase of 21.33%, the current average surpasses the previous average price target of $45.33.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of TTM Technologies by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Ricchiuti | Needham | Raises | Buy | $65.00 | $56.00 |

| James Ricchiuti | Needham | Maintains | Buy | $56.00 | $56.00 |

| Ruben Roy | Stifel | Raises | Buy | $55.00 | $40.00 |

| James Ricchiuti | Needham | Raises | Buy | $56.00 | $43.00 |

| Mike Crawford | B. Riley Securities | Raises | Buy | $50.00 | $36.00 |

| William Stein | Truist Securities | Raises | Buy | $48.00 | $41.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to TTM Technologies. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of TTM Technologies compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of TTM Technologies's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of TTM Technologies's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on TTM Technologies analyst ratings.

Discovering TTM Technologies: A Closer Look

TTM Technologies Inc manufactures technology solutions, including mission systems, radio frequency (RF) components/RF microwave/microelectronic assemblies, quick-turn and technologically printed circuit boards (PCB). The company is based in the United States and derives roughly half of its revenue domestically. It organizes itself into two segments: printed circuit boards and RF&S Components. The printed circuit boards segment, which contributes the majority of revenue, offers a range of printed circuit boards as well as layout design and simulation, and testing services. TTM Technologies' products are used in manufacturing, networking, telecommunications, computing, aerospace, and medical fields.

TTM Technologies's Economic Impact: An Analysis

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3M period, TTM Technologies showcased positive performance, achieving a revenue growth rate of 20.74% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: TTM Technologies's net margin excels beyond industry benchmarks, reaching 5.68%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): TTM Technologies's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.58% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): TTM Technologies's ROA stands out, surpassing industry averages. With an impressive ROA of 1.18%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: TTM Technologies's debt-to-equity ratio stands notably higher than the industry average, reaching 0.63. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.