17 Analysts Have This To Say About Expedia Group

Analysts' ratings for Expedia Group (NASDAQ:EXPE) over the last quarter vary from bullish to bearish, as provided by 17 analysts.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 12 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 3 | 0 | 8 | 1 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

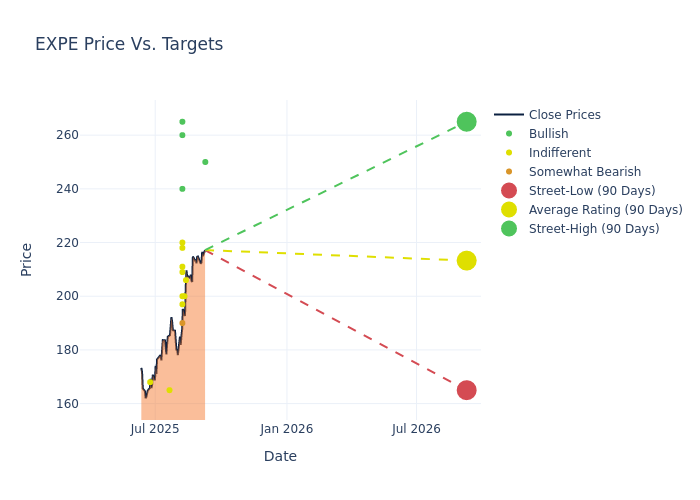

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $209.35, a high estimate of $265.00, and a low estimate of $165.00. Witnessing a positive shift, the current average has risen by 14.66% from the previous average price target of $182.59.

Interpreting Analyst Ratings: A Closer Look

The standing of Expedia Group among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jake Fuller | BTIG | Maintains | Buy | $250.00 | $250.00 |

| Ronald Josey | Citigroup | Raises | Neutral | $206.00 | $177.00 |

| Shyam Patil | Susquehanna | Raises | Neutral | $200.00 | $175.00 |

| Tom White | DA Davidson | Raises | Neutral | $218.00 | $174.00 |

| Brad Erickson | RBC Capital | Raises | Sector Perform | $200.00 | $180.00 |

| Scott Devitt | Wedbush | Raises | Neutral | $220.00 | $175.00 |

| Stephen Ju | UBS | Raises | Neutral | $209.00 | $182.00 |

| Ken Gawrelski | Wells Fargo | Raises | Equal-Weight | $211.00 | $178.00 |

| Daniel Kurnos | Benchmark | Raises | Buy | $265.00 | $215.00 |

| Trevor Young | Barclays | Raises | Equal-Weight | $197.00 | $190.00 |

| Naved Khan | B. Riley Securities | Raises | Buy | $260.00 | $222.00 |

| Thomas Champion | Piper Sandler | Raises | Underweight | $190.00 | $135.00 |

| Justin Post | B of A Securities | Raises | Buy | $240.00 | $211.00 |

| Stephen Ju | UBS | Raises | Neutral | $182.00 | $166.00 |

| Brian Nowak | Morgan Stanley | Raises | Equal-Weight | $165.00 | $150.00 |

| Ken Gawrelski | Wells Fargo | Raises | Equal-Weight | $178.00 | $149.00 |

| Greg Miller | Truist Securities | Lowers | Hold | $168.00 | $175.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Expedia Group. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Expedia Group compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Expedia Group's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Expedia Group's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Expedia Group analyst ratings.

All You Need to Know About Expedia Group

Expedia is the world's second-largest online travel agency by bookings, offering services for lodging (80% of total 2024 sales), air tickets (3%), rental cars, cruises, in-destination, and other (10%), and advertising revenue (7%). Expedia operates a number of branded travel booking sites, but its three core online travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

Key Indicators: Expedia Group's Financial Health

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3M period, Expedia Group showcased positive performance, achieving a revenue growth rate of 6.41% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Expedia Group's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 8.72%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Expedia Group's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 34.59%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Expedia Group's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.24% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Expedia Group's debt-to-equity ratio surpasses industry norms, standing at 7.75. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.