Kenvue Stock: A Deep Dive Into Analyst Perspectives (8 Ratings)

Across the recent three months, 8 analysts have shared their insights on Kenvue (NYSE:KVUE), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 6 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 3 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

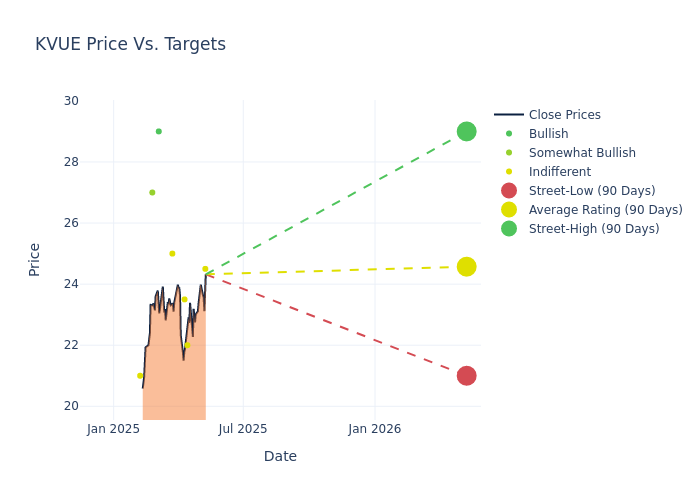

Analysts have set 12-month price targets for Kenvue, revealing an average target of $24.5, a high estimate of $29.00, and a low estimate of $22.00. Witnessing a positive shift, the current average has risen by 8.89% from the previous average price target of $22.50.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Kenvue among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Filippo Falorni | Citigroup | Raises | Neutral | $24.50 | $22.00 |

| Filippo Falorni | Citigroup | Raises | Neutral | $22.00 | $21.00 |

| Lauren Lieberman | Barclays | Lowers | Equal-Weight | $22.00 | $23.00 |

| Edward Lewis | Redburn Atlantic | Announces | Neutral | $23.50 | - |

| Lauren Lieberman | Barclays | Raises | Equal-Weight | $23.00 | $21.00 |

| Javier Escalante | Evercore ISI Group | Announces | In-Line | $25.00 | - |

| Susan Anderson | Canaccord Genuity | Raises | Buy | $29.00 | $24.00 |

| Korinne Wolfmeyer | Piper Sandler | Raises | Overweight | $27.00 | $24.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Kenvue. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Kenvue compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Kenvue's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Kenvue's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Kenvue analyst ratings.

Discovering Kenvue: A Closer Look

Kenvue is the world's largest pure-play consumer health company by sales, generating $15 billion in annual revenue. Formerly known as Johnson & Johnson's consumer segment, Kenvue spun off and went public in May 2023. It operates in a variety of silos within consumer health, such as cough, cold and allergy care, pain management, face and body care, and oral care, as well as women's health. Its portfolio has some of the most well-known brands in the space, including Tylenol, Listerine, Johnson's, Aveeno, and Neutrogena. Despite playing in a fragmented industry with intense competition and changing consumer preferences, many of Kenvue's brands are the global leader in their respective segment thanks to their strong brand power.

Kenvue: Delving into Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Challenges: Kenvue's revenue growth over 3M faced difficulties. As of 31 December, 2024, the company experienced a decline of approximately -0.11%. This indicates a decrease in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 8.0%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Kenvue's ROE stands out, surpassing industry averages. With an impressive ROE of 2.89%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Kenvue's ROA excels beyond industry benchmarks, reaching 1.12%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.9, Kenvue adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.